海外研报

筛选

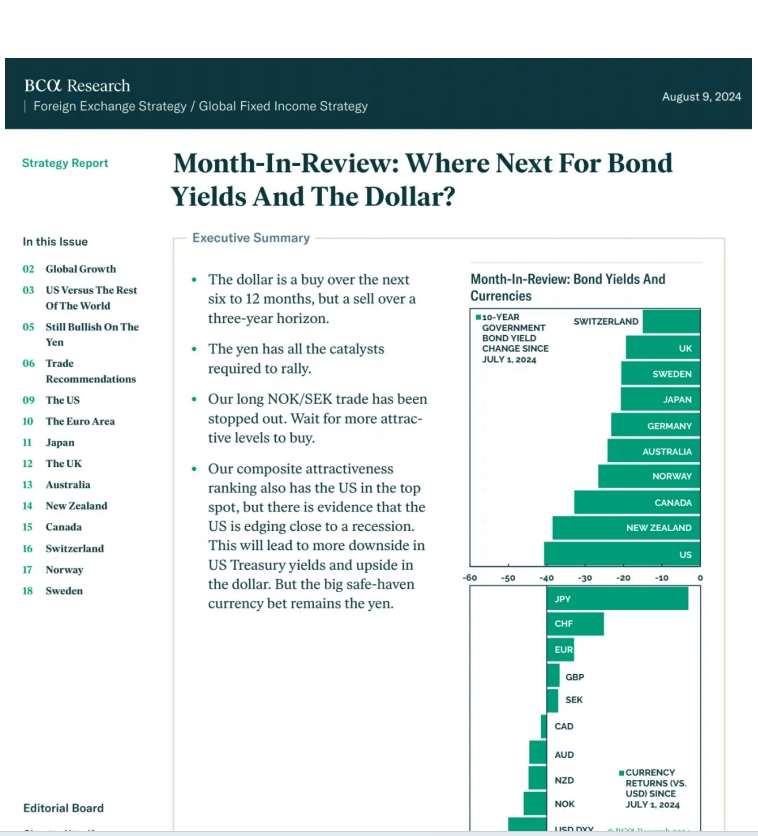

Month-In-Review: Where Next For BondYields And The Dollar?

The dollar is a buy over the nextsix to 12 months, but a sell over athree-year horizon.The yen has all the catalystsrequired to rally.

海外研报

2024年08月12日

Sunday Start | What's Next in Global Macro Derivative Thinking

All attention this week will be on Jackson Hole, where the conference has been aptly titled “Reassessing the Effectiveness and Transmission of Monetary Policy.” We

海外研报

2024年08月19日

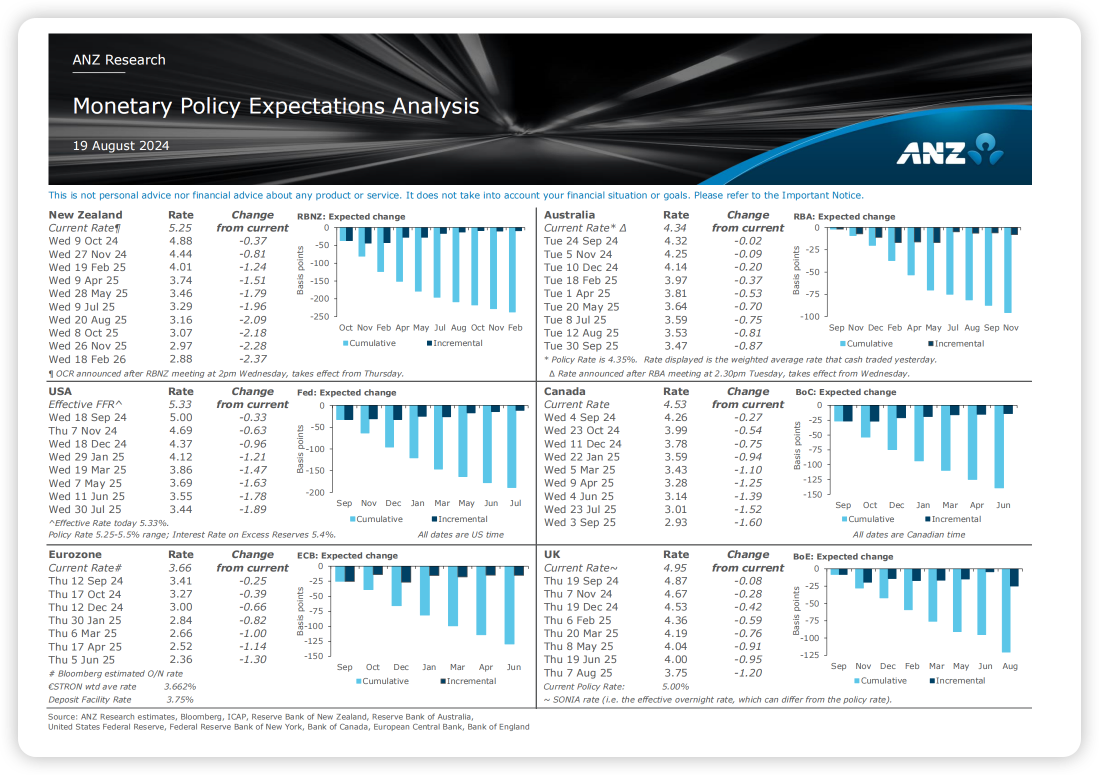

Monetary Policy Expectations Analysis

The opinions and research contained in this document (in the form of text, image, video or audio) are (a) not personal financial advice nor financial advice about any product or service; (b) provided for

海外研报

2024年08月20日

All That Glitters

Gold prices traded at fresh all-time highs on Friday, closing well above the $2600/oz barrier. The rally in gold seems unstoppable at this point and resets on the all-time-high are becoming a

海外研报

2024年09月25日

BofA - Gonzalo Asis - Trading Catalysts Uncertainty removed. What’s ahead for equities_20240922

Economics: First cut, now back to data-dependence The Fed cut rates by 50bp last week as it seeks to recalibrate policy to a more neutral

海外研报

2024年09月25日

China_s_stimulus_package_ten_reactions

Today’s announcement confirms our view that the Fed cut has opened the door for monetary policy injection. The People’s Bank of China

海外研报

2024年09月25日

Investor Sentiment: Risk-Love A binary call

Global Risk-Love resets to neutralGlobal Risk-Love, our contrarian sentiment indicator for equities, has plummeted from

海外研报

2024年08月14日

2024Q2: Hardware Investment Grows, Barriers to Profitable Use Remain (Kodnani)

AI-related investment growth remains strong, particularly for semiconductorfirms, where equity markets expect revenue growth of around 50% from currentlevels by the end of 2025. Since the release of ChatGPT, equity markets have

海外研报

2024年07月04日